Investing in real estate has long been a cornerstone for building wealth and financial security. In a rapidly developing nation like India, the real estate market continues to offer substantial opportunities for investors. This guide explores why 2024 is a pivotal year for real estate investment in India, the various types of investments available, and the trends shaping this dynamic sector.

Types of Real Estate Investments

1. Residential Properties

Residential properties remain one of the most popular choices for investors. Whether it’s apartments, villas, or standalone houses, these assets offer steady appreciation over time. Additionally, rental income from residential units can provide a consistent cash flow.

2. Commercial Spaces

Office spaces, retail shops, and coworking hubs fall under the category of commercial real estate. With the resurgence of the office culture and growing e-commerce sectors, commercial spaces are witnessing increased demand, especially in metropolitan cities.

3. REITs (Real Estate Investment Trusts)

For those looking to invest without directly purchasing property, REITs provide a viable option. These are companies that manage a portfolio of properties and offer shares to investors, enabling participation in real estate markets without owning physical assets.

4. Land Investments

Purchasing land is a long-term strategy that offers high returns, especially in emerging areas with future growth potential. It requires less maintenance compared to other property types and provides flexibility for future development.

Benefits of Real Estate Investment

1. Tangible Asset with Long-Term Appreciation

Real estate is a physical asset that rarely depreciates in value over the long term. Properly chosen properties often see significant value appreciation, providing substantial capital gains.

2. Passive Rental Income

Owning rental properties generates a steady stream of income, which can be reinvested or used to cover daily expenses. With India’s growing population and urbanization, the demand for rental units is increasing.

3. Hedge Against Inflation

Real estate investments often perform well during inflationary periods. As property values and rental income rise, they offer a financial cushion against inflation.

4. Portfolio Diversification

Including real estate in your investment portfolio reduces risk by diversifying asset types. It provides stability, especially when other markets, like equities, are volatile.

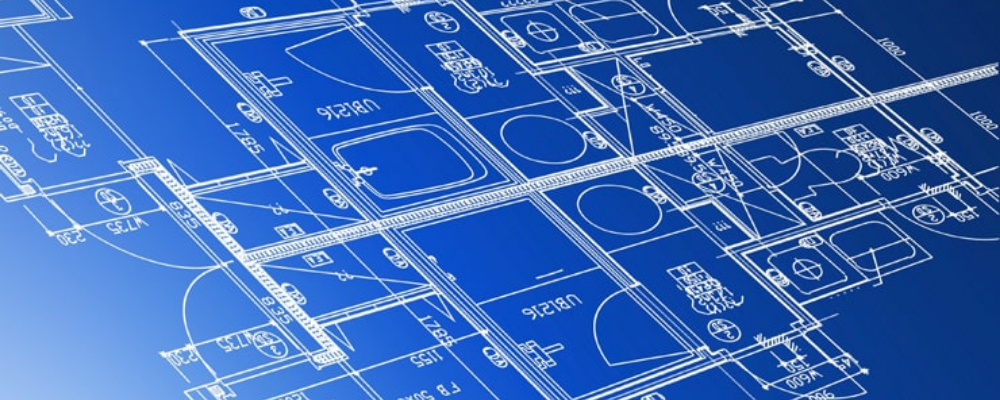

Factors to Consider Before Investing

1. Location and Market Demand

The location of the property is a critical factor. Urban areas with robust infrastructure, job opportunities, and connectivity tend to have higher demand and appreciation rates.

2. Legal and Regulatory Checks

Ensure the property has a clear title and complies with legal requirements. Check for RERA (Real Estate Regulatory Authority) certification to avoid fraudulent practices.

3. Budget and Financing Options

Assess your financial situation and explore home loan options if required. Calculate the ROI (Return on Investment) to ensure profitability.

4. Future Growth Prospects

Invest in areas with planned developments like metro extensions, industrial hubs, or IT parks. Such locations offer higher chances of appreciation over time.

Current Trends in the Indian Real Estate Market

1. Increasing Demand for Affordable Housing

Government initiatives like PMAY (Pradhan Mantri Awas Yojana) are driving demand for affordable housing, particularly in Tier 2 and Tier 3 cities.

2. Rise of Green and Sustainable Buildings

Eco-friendly buildings are gaining traction as buyers and investors prioritize energy efficiency and sustainability. Developers offering green-certified buildings are seeing increased interest.

3. Growth of Co-Living and Shared Spaces

With the rise of the gig economy and younger workforce, co-living spaces are emerging as a viable alternative to traditional housing. These spaces offer affordability and community living.

4. Impact of Government Policies

Government reforms like RERA have increased transparency and accountability, making real estate investments more secure. Tax benefits and subsidies further encourage investments in this sector.

Strategies for Real Estate Investment

1. Long-Term Investment

Real estate is ideally suited for long-term goals. Opt for properties in developing areas with strong growth potential. Patience is key as such investments often yield substantial returns over time.

2. Flipping Properties

Flipping involves purchasing undervalued properties, renovating them, and selling at a higher price. This strategy requires a keen eye for properties with value-addition potential and an understanding of market trends.

3. Leverage REITs

If managing properties seems daunting, invest in Real Estate Investment Trusts. They offer liquidity and lower entry barriers, making them an attractive option for beginner investors.

4. Diversify Across Sectors

Spread your investments across residential, commercial, and industrial properties. Diversification minimizes risk and optimizes returns, especially during market fluctuations.

5. Focus on Rental Income

Investing in properties with high rental demand ensures consistent income. Analyze rental yields in potential areas before purchasing.

Top Locations for Real Estate Investment in 2025

1. Mumbai Metropolitan Region (MMR)

Known for its robust infrastructure and thriving job market, MMR offers opportunities across residential and commercial real estate. Emerging areas like Thane and Navi Mumbai are hotspots.

2. Bengaluru

India’s IT hub continues to attract professionals, driving demand for residential and rental properties. Areas like Whitefield and Electronic City remain popular among investors.

3. Hyderabad

With affordable property prices and rapid infrastructural development, Hyderabad is a top choice for investors. IT corridors like Hitech City offer lucrative opportunities.

4. Pune

Known for its pleasant climate and educational institutions, Pune attracts young professionals and students. Areas like Baner and Hinjewadi are witnessing significant growth.

5. Chennai

Chennai’s industrial and IT sectors make it a stable market for real estate investment. Focus on areas like OMR (Old Mahabalipuram Road) for high ROI.

Tips for Successful Real Estate Investment

1. Research the Market

Stay updated on market trends, government policies, and economic factors influencing real estate. Knowledge is your greatest asset.

2. Inspect Properties Thoroughly

Conduct site visits and inspections to assess the property’s condition and location. Hire a professional if necessary to identify potential red flags.

3. Negotiate Smartly

Don’t shy away from negotiating the property price. A well-negotiated deal can significantly enhance your profit margins.

4. Leverage Technology

Use online platforms for property searches, price comparisons, and legal verification. Digital tools simplify the investment process.

5. Consider Tax Implications

Understand the tax benefits of real estate investments, including deductions on home loans and exemptions on rental income.

FAQs on Real Estate Investment in India

1. What are the key factors to consider before investing in real estate in India?

Location, market demand, legal compliance, and future growth potential are crucial factors.

2. Are REITs a good option for beginners?

Yes, REITs are an excellent choice for beginners as they offer exposure to real estate without the need for property ownership.

3. How can I finance my real estate investment?

Home loans, personal savings, and partnerships are common financing options. Always compare interest rates and terms before borrowing.

4. What are the risks involved in real estate investment?

Risks include market fluctuations, liquidity issues, and potential legal disputes. Research and due diligence can mitigate these risks.

5. Is real estate a good investment for 2024?

Yes, with government reforms, infrastructure development, and rising urbanization, 2024 presents ample opportunities for real estate investors.